The City of Long Beach has started accepting applications for a $29-million emergency rental assistance program intended for renters and landlords facing financial hardship due to the COVID-19 pandemic.

The program, which is separate from similar efforts run by the State of California, the City of Los Angeles, and Los Angeles County, is only open to residents and property owners in Long Beach. Money granted through the program can be used to pay back rent and utility bills, with a priority on lower-income tenants who have been unemployed for at least 90 days.

Under parameters set by the state legislation SB 91, landlords participating in the emergency rental assistance program can be reimbursed 80 percent of an eligible tenant's unpaid rent from April 1, 2020 to March 31, 2021 if they agree to waive the remaining 20 percent of unpaid rent during that time period. If a landlord chooses not to participate, an eligible tenant can still receive 25 percent of unpaid rent over the same time period.

Likewise, eligible tenants could receive future rental assistance equivalent to 25 percent of monthly rent for up to three months.

Additionally, tenants may receive assistance for unpaid utility bills through April 1, 2020 and March 31, 2021. The program would pay the full unpaid amount for a period of up to 12 months. Tenants are required to provide documentation that the bills are in their name, and directly related to their homes. Payments will be made directly to the utility provider.

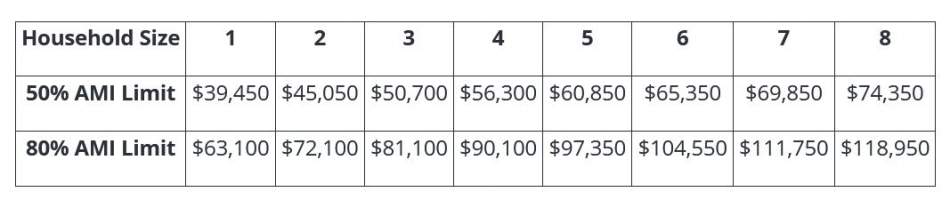

Eligible households are limited to those earning 80 percent or less than the area median income, with households earning 50 percent or less than the median or facing housing insecurity receiving priority. A breakdown of income limits based on household size is as follows:

According to the City of Long Beach, landlord applicants will be required to provide:

- Valid government ID with photograph or business license;

- Proof of ownership of the property (mortgage statement or tax bill) or documentation you have the authority to act on the owner’s behalf;

- Copies of lease or rental agreements, or other documentation reflecting tenant’s name, residence address, and monthly amount due; and

- IRS Form W-9, 1040 NR, or 1040 NR-EZ.

Tenant applications must provide:

- a phone number and e-mail address;

- proof of rental agreement; proof of income;

- proof of unemployment or income loss due to COVID-19;

- proof of housing instability;

- proof of utility bills showing amounts owed;

To apply or seek additional information, visit the emergency rental assistance program's website.